Private credit is any type of debt financing provided by nonbank lenders/funds that is not issued or traded in an open market.

Emergence of this asset class globally

• Globally, private debt expanded rapidly after the Global Financial Crisis when banks pulled back from leveraged lending and concentrated their corporate operations on larger clients

• An appetite for attractive returns, speedy executions and rich opportunities continues to expand the market, globally with Moody’s estimating the market to reach at least $2.0 trillion by 2027

• The global market is growing by an average of 10+% every year

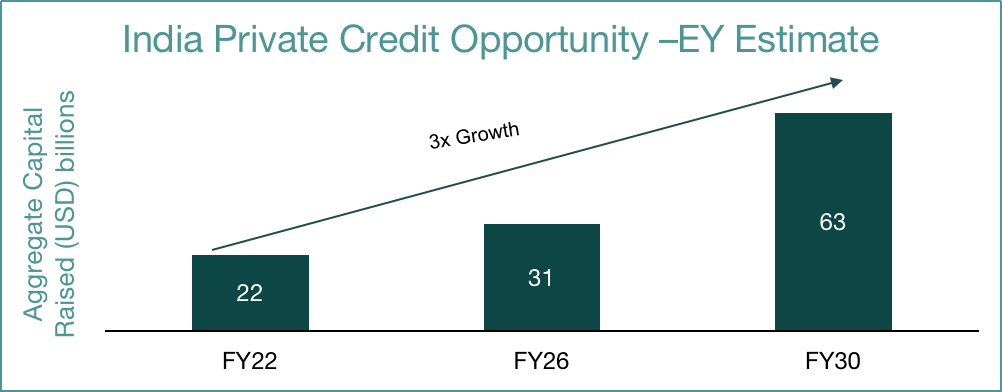

Private Credit in India is at an inflection point

• The private credit market has witnessed a significant interest among high-net-worth individual & institutional investors

• Slowdown in Bank, NBFC and Mutual Fund wholesale lending has led to a rapid increase in AIF opportunity

Modulus Alternatives

Centrum Alternatives is now known as Modulus Alternatives.

Modulus Alternatives is a private credit platform that focuses on mid-market, performing credit opportunities. The firm seeks to provide attractive, risk-adjusted returns to investors and custom-made solutions to its portfolio companies.

Set up in 2018, Modulus Alternatives is one of the early movers in the Indian private credit space and till date, have an invested capital aggregating to over INR 2,945 crore and have returned more than INR 1,685 crore to our investors.

The platform has so far made 26 investments and have successfully exited 16 of these investments.

The shareholding of Modulus Alternatives is held by Mr. Jaspal Bindra led Centrum Group and Mr. Alok Agarwal, former Chief Financial Officer, Reliance Industries Limited.

A CAT II Alternative Investment Fund, ICOF II, will invest in the performing credit space and aims to capitalize on the immense potential of the private credit market in India.

To learn more about Modulus Alternatives and its funds, please click here.